Safest Mutual Fund: In today’s market, where there is a plethora of mutual funds ranging from Large Cap to Mid Cap, Flexi, Hybrid, and Small Cap, choosing the right one can be confusing, especially for new investors. To address this, we are recommending a mutual fund in which we have personally invested for nearly two years.

Who is this Mutual Fund for?

This mutual fund is suitable for those who are new to investing and have previously only invested in Fixed Deposits (FDs), which typically offer interest rates ranging from 7.1% to 7.5%. For such investors, this fund can prove to be an excellent alternative because after adjusting taxes and inflation FDs offer relatively lower returns as compared to mutual funds.

Therefore, if you are a new investor and always scared to invest in mutual funds then this hybrid fund can be a relatively safer instrument.

Who is this Mutual Fund not for?

If you are already invested in a variety of funds, particularly in equity, this fund may not offer significant advantages for you. Being a Hybrid fund, it invests in a mix of equity, debt, and cash, providing diversification but potentially lower returns compared to equity-focused funds.

What is the name of this Mutual Fund?

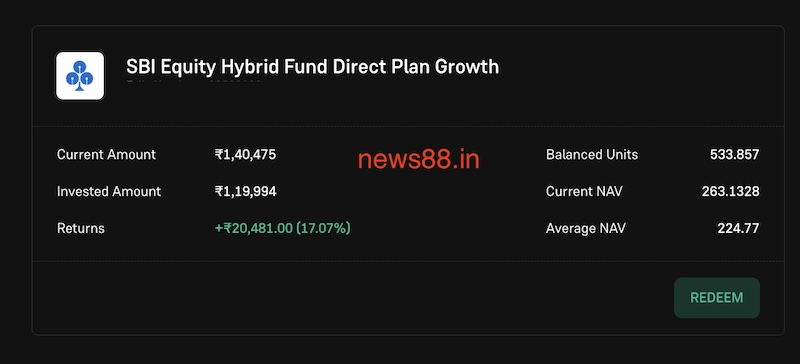

This is an SBI Equity Hybrid Fund Direct Growth, in which we began a SIP (Systematic Investment Plan) of ₹5000 in January 2022. Over two years, it has provided an annual return of approximately 17%, surpassing returns from any type of FD.

Also read: 3 Mutual Funds which Give Stability of Debt Fund and Growth of Equity

What is the expense ratio of this Mutual Fund?

The expense ratio of this fund is 0.75%.

What is the exit clause of this Mutual Fund?

You can invest in this fund either through SBI Mutual Fund’s direct website or through discounted broker platforms such as Groww, Upstox, INDmoney, ET Money, or Zerodha. The minimum investment amount is ₹500 through SIP and ₹1000 as a lump sum.

Where and how much to invest in this Mutual Fund?

You can invest in this fund either through SBI Mutual Fund’s direct website or through discounted broker platforms such as Groww, Upstox, INDmoney, ET Money, or Zerodha. The minimum investment amount is ₹500 through SIP and ₹1000 as a lump sum.

What is the fund’s rating and its historical returns?

This fund has a 3-star rating and has provided impressive returns compared to FDs. Below are the annual returns generated by this fund

Our Investment

Through SIP, we have invested approximately ₹1,20,000 in this fund, which has yielded a return of 17.07%.

By investing in SBI Equity Hybrid Fund Direct Growth, investors can potentially enjoy higher returns compared to Fixed Deposits, making it a compelling choice for those venturing into mutual fund investments.