IRFC Share Price Target (NSE/BSE): When considering investing in PSU stocks, it’s crucial to take into account both technical and financial analyses. These factors become essential for long-term investments because potential fluctuations may occur due to changes in government policies. Therefore, it’s crucial for a stock to be fundamentally strong.

In this article, we will delve into the financial and technical data to determine the IRFC share price targets not only for 2024 but also for following years such as 2025, 2026, 2030 and 2040. The share price target for IRFC that we are discussing can fluctuate based on national, regional, and government policies.

Current Status of IRFC Share

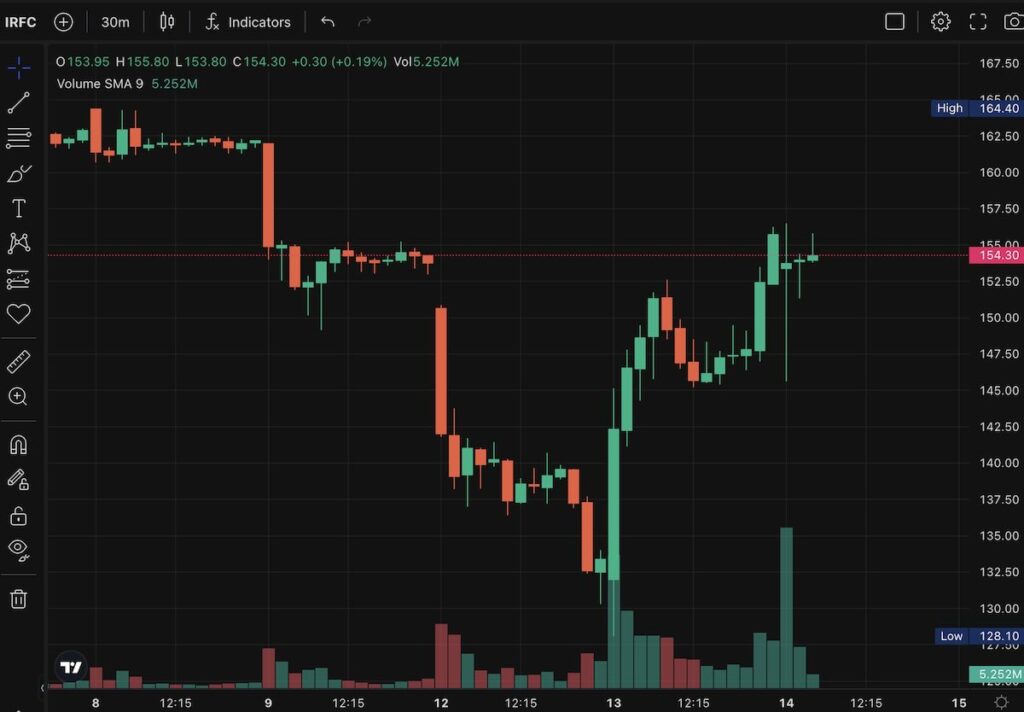

In February 2024, IRFC Ltd achieved a 52-week high on the National Stock Exchange, reaching a price of ₹192.35. However, due to profit booking by investors, there has been significant selling pressure on the stock this week, causing its price to decline steadily, closing at ₹153.45 on February 13, 2024.

Nevertheless, when the market opened on February 14, 2024, the stock broke its previous day’s record, reaching a high of ₹156.50 at 10:23 AM. Currently, traders and investors are re-entering the stock, initiating heavy buying activity.

Also read: NCL Research and Financial Services Share Price Target 2024, 2025, 2026, 2030

IRFC Share Price Target 2024

Considering the current state of IRFC’s share, it appears that its target price for February 2024 should be around ₹146. If it surpasses the resistance at ₹165, the path ahead could become smoother, potentially leading to a rally.

Last year in March 2023, this share was priced around ₹26.60, which has now surged to ₹154 in February of this year, delivering six-fold returns to investors over the year.

| Months | IRFC Share Target Price 2024 |

|---|---|

| Feb | ₹146 |

| Mar | ₹150 |

| Apr | ₹175-180 (Unstability During Elections) |

| May | ₹165-180 (Unstability During Elections) |

| Jun | ₹165 |

| Jul | ₹175 |

| Aug | ₹185 |

| Sep | ₹193 |

| Oct | ₹190 |

| Nov | ₹180 |

| Dec | ₹200 |

IRFC Share Price Target 2025

It is speculated that the upcoming general elections in India in 2024 could determine the direction of the share. If there is a change in government in the foreseeable future, it could lead to amendment in ongoing government policies, impacting the stock either positively or negatively. However, if the current government is re-elected, there might not be significant fluctuations in the stock’s status.

During elections, stocks might experience temporary high volatility, but wise investors can benefit from both upward and stable market conditions by buying when the market is down and holding for the long term. Speculative traders may engage in BTST (Buy Today Sell Tomorrow) and scalping strategies to capitalize on short-term profits.

Let’s take a look at the table below to see the expected target price for IRFC shares in 2025.

| Months | IRFC Share Target Price 2025 |

|---|---|

| Feb | ₹210 |

| Mar | ₹215 |

| Apr | ₹195 |

| May | ₹220 |

| Jun | ₹224 |

| Jul | ₹260 |

| Aug | ₹254 |

| Sep | ₹270 |

| Oct | ₹277 |

| Nov | ₹255 |

| Dec | ₹260 |

IRFC Share Price Target 2026

If the Indian Railway Finance Corporation Limited achieves its target by December 2025, its share price is expected to reach ₹500 by the end of 2026.

IRFC Share Price Target 2030

By 2030, the government’s focus in India will predominantly be on bullet trains. This period will witness increased infrastructure spending, which will be favorable for IRFC. If the share reaches ₹500 by the end of 2026, it will be soaring, and it’s estimated that by 2030, the target price for IRFC shares could be around ₹1100-₹1200 per share

IRFC Share Price Target 2040

In this era of infrastructure and railway development, when governments are primarily focused on bullet and high-speed trains, the share price is expected to reach its peak. By the end of 2040, the share price could range between ₹2100 to ₹2500.

IRFC Share Fundamentals and Technicals

If we look at the fundamentals of Indian Railway Finance Corporation Limited (IRFC), its market capitalization as of February 2024 stands at ₹200,471 crores. The company’s P/E (Price-to-Earnings) ratio is 31.65, which is significantly higher than its peers.

| Founded in Year | 1986 |

| CRISIL Rating | AAA |

| ICRA Rating | AAA |

| CARE Rating | AAA |

| Market Cap (in 2024) | ₹200,471 crores |

| Net Worth (in 2023) | ₹45,470 crores |

| P/E | 31.65 |

| P/B | 4.15 |

| Industry P/E | 24.25 |

| Debt to Equity | 8.54 |

| ROE (Return on Equity) | 12.51% |

| EPS (Earning Per Share) | 4.62 |

| Dividend Yield | 0.98% |

| Pledged Holding | No |

| Total Promoters Holding (Mar-Dec 23) | 86.36% |

| FII Holding (Mar-Dec 23) | 1.15% |

| Domestic Institutions Holding (DII) | 0.76% |

In terms of revenue, IRFC’s annual growth rate is 25.6%, which is substantially higher compared to similar companies whose revenue grows at a rate of only 10.8%. The company has consistently shown good growth over the years. In the financial year 2022, after tax, its profit was ₹6089 crores, which increased to ₹6337 crores in 2023. Over the past five years, the company’s market share has increased from 8.73% to 13.42%.

A positive aspect of IRFC is its regular dividend payment to shareholders, with dividends of approximately 7 to 8 percent being paid in September and November each year.

Finance Disclaimer: Please note that the information provided on this website is not a financial advice or a stock recommendation. The information provided on the website is only for knowledge and education purposes. Therefore, we advise you to always invest after careful consideration, as we (news88.in or its associates) are not held responsible for any financial losses in stocks, mutual funds, securities or any financial related instruments. Consult your financial advisor before investing.