Platinum Industries Ltd IPO: Platinum Industries Ltd is soon launching its IPO, with bidding set to take place from February 27 to 29, 2024. The IPO will close after the bidding period ends on February 29. Allotment will take place on March 1, followed by the refunds on March 4, 2024 for those who subscribed but did not receive any shares. The company will be listed on the NSE/BSE stock exchanges on March 5, 2024.

The IPO aims to raise approximately ₹235.32 crores. During the IPO, the share price will range from ₹162 to ₹171, with a minimum lot size of 87 shares, requiring an investment of at least ₹14,094.

General individuals can invest up to ₹2 lakh, while high net worth individuals can invest up to ₹5 lakh in the IPO.

About Platinum Industries Ltd

Platinum Industries Ltd was established in 2016, with Krishna Rana as its managing director. The company manufactures PVC pipes, electrical wires, lubricants, fittings, tiles, PVC foam boards and various chemicals such as titanium dioxide. It operates both domestically and internationally, with distribution networks in 12 locations across India and exports to foreign markets. The company also has a research and development (R&D) lab spanning 3351.82 sq. ft in Palghar, Maharashtra, focusing on discovering new chemicals.

Platinum Industries Ltd Fundamentals

- In terms of fundamentals, Platinum Industries Ltd has only one manufacturing plant in Palghar, Maharashtra. Any legal or regional issues could significantly impact its business.

- The majority of the company’s revenue comes from 10 major customers, accounting for 87.7%, 83.41%, and 86.49% of sales in FY2021, FY2022, and FY2023, respectively. This implies that any issues with these customers could adversely affect the company’s business.

- In FY2022, the company had negative cash flow, which could pose challenges if this trend continues.

- Some of the promoters and directors of the company are involved in ongoing court cases, the outcomes of which could affect the company negatively.

- As of September 30, 2023, the company has an unsecured loan of approximately ₹9.96 crores.

- However, it’s worth noting that the company has generated profits of ₹4.82 crores (FY2021), ₹17.75 crores (FY2022), and ₹37.58 crores (FY2023) in the past three years.

Platinum Industries Ltd Cash Flow Statement

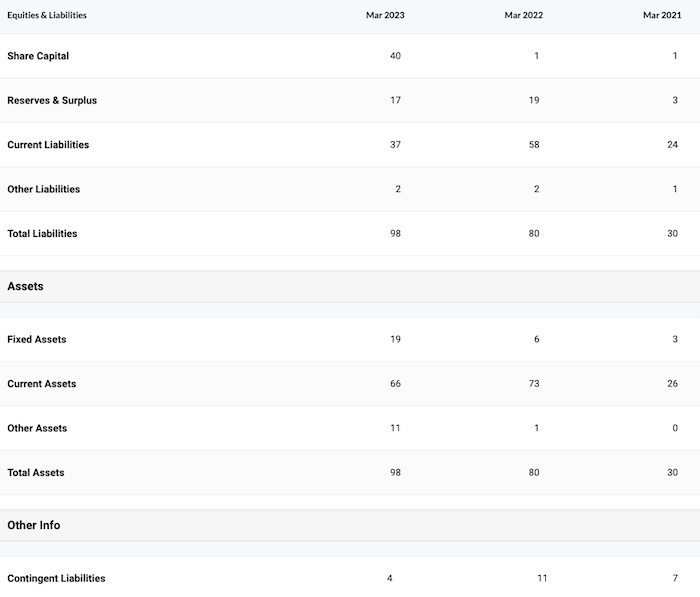

Platinum Industries Ltd Balance Sheet

Why Platinum Industries Ltd is doing IPO?

The funds raised through the IPO will be used to expand the company’s business. It plans to open a second manufacturing unit in Palghar and invest some funds in Platinum Stabilizers Egypt LLC to establish another unit in Egypt.

To apply for Platinum Industries Ltd IPO, investors can use platforms like Groww app, 5paisa, or other brokerage apps.

The promoters of Platinum Industries Ltd are Krishna Dushyant Rana and Parul Krishna Rana. The company’s registered office is located in Andheri (East), Mumbai.

Finance Disclaimer: Please note that the information provided on this website is not financial advice or stock recommendation. The information provided on the website is partly sourced from the credible brokerage and research firms. Therefore, we advise you to always invest after careful consideration, as we are not responsible for any financial risks associated with stock market investments. Consult your financial advisor before investing.